$165.00 inc GST

Online Compliance Course

Course preview

At a glance

Course length:

30-45 minutes online

Regulation/Law:

National Consumer Credit Protection Act 2009

Course audience:

All personnel at financial institutions who may provide credit

Region:

Available in Australian content format

Course type:

Structured iDesigned for learners with little prior knowledge, this course type takes the learner through the course subject sequentially – one step at a time. and Accelerated iThis course type is designed for learners with prior knowledge, giving learners more ability to self-direct how they engage with the full course content. Using scenarios with voice-overs, tests within the course, and a ‘Learn More’ option, learners can engage the course on any smartphone, tablet, or PC.

Delivery:

Deploy our courses online via Safetrac’s Compliance LMS or opt for SCORM delivery on your company’s LMS.

About this course

In 2010, state and territory-based credit laws were moulded into a national approach known as the National Consumer Credit Code.

With it, a large range of requirements and obligations were added. Failure to comply with these can have very serious consequences for those involved.

Safetrac’s ‘National Consumer Credit Protection’ course focuses on the application of the Act, your obligations and how to comply with them.

Learning outcomes

On completing this course, learners should be able to:

- understand when the legislation applies;

- outline criminal and civil penalties;

- outline licenses and licensee obligations;

- outline responsible lending conduct;

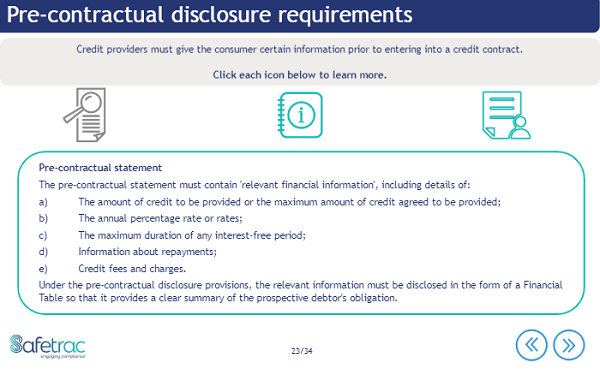

- be aware of pre-contractual conduct and disclosure;

- understand the content requirements for documents;

- outline ongoing obligations and enforcement;

- understand ending and enforcing credit contracts; and

- outline particular types of contracts.

Course contents

- The law

- Criminal penalties for breach

- The code specifics

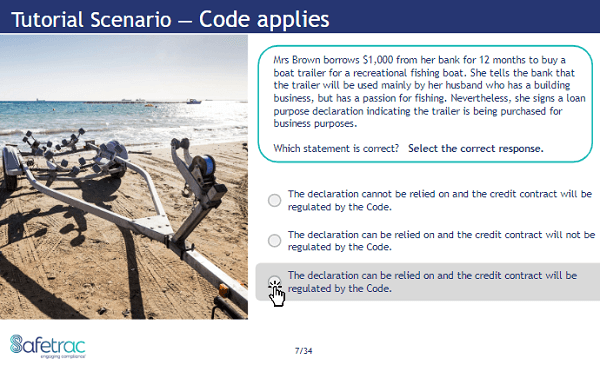

- TS1 – When does the code apply?

- Overview of licence requirements

- TS2 – Responsible lending conduct

- TS3 – Unsuitability assessment

- Pre-contractual conduct

- TS4 – Canvasing credit at home

- Requirements of pre-contractual disclosure

- Contract specifics

- More about mortgages

- Guarantees and guarantors

- Statements, unjust transactions and other charges

- General information about notices

- Unjust transactions

- TS5 – Guarantors right to withdraw

- Enforcements

Enquire about this online course

We can provide trial access to preview this course. Enquire today about training your organisation with Safetrac.

Or submit the form below