A year in review: The year esg and climate-related financial disclosures were redefined

- Updated

- 4 min

ESG considerations took center stage in 2024, changing how companies worldwide, including in Australia, disclose climate-related risks. What was once voluntary or investor-driven is now a regulated, strategic priority, gaining momentum into 2025.

This year saw the maturing of ESG and climate-related financial disclosure into something more than a reporting exercise — it became a foundation for credibility, resilience, and long-term value. Global bodies releasing IFRS S1 and S2, along with investor pressure for consistent data, has redefined company disclosure practices.

In Australia, regulators like ASIC and APRA are adopting global ESG standards. As a result, stakeholders expect companies to go beyond compliance and link climate risks to financial performance, transition plans, and strategy. Furthermore, as assurance and anti-greenwashing scrutiny grew, stakeholders also raised the bar for rigor, relevance, and results.

In this year-in-review, we explore the major developments that shaped ESG and climate-related financial disclosures — and what they mean for the road ahead.

At a glance

Understanding your responsibility under new Environmental, Social and Governance legislation

Australia’s new mandatory climate-related financial disclosures will significantly enhance how businesses communicate climate risks and opportunities. By aligning with global standards, these disclosures aim to build investor confidence while also supporting the broader net-zero transition.

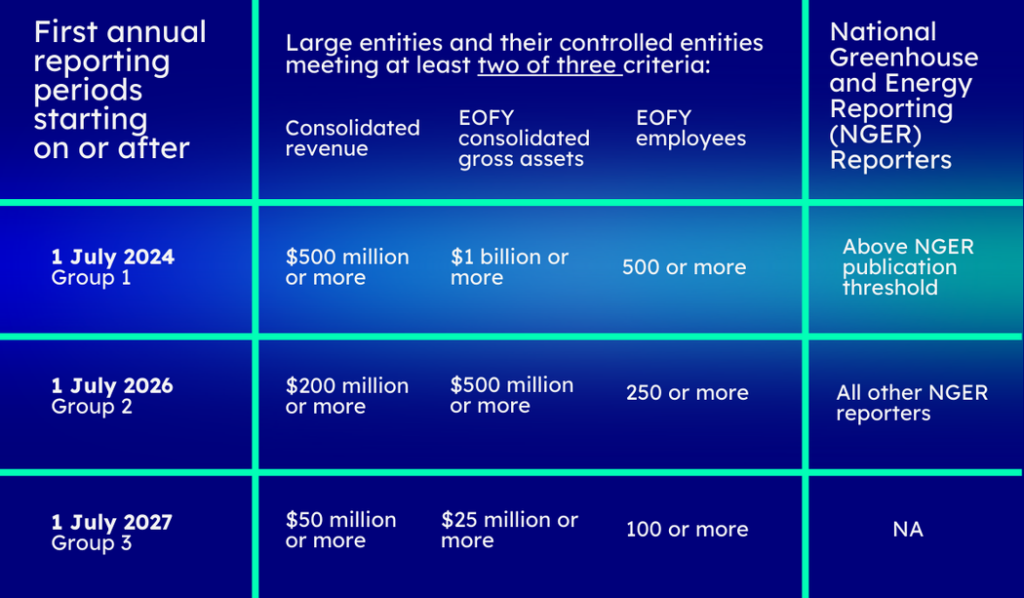

Beginning on 1 July 2025, businesses that meet any of the following thresholds—$50 million or more in revenue, $25 million or more in assets, or over 100 employees—must include climate-related data in their annual reports. Furthermore, regulators will have the authority to take action if companies fail to comply with these obligations.

To ease the transition, the government has planned a phased rollout, ensuring that businesses have adequate time and support to adapt. Stakeholders expect this approach to enhance transparency, ultimately fostering greater investment in Australia’s green economy.

Learn more with:

- ESG in 2025: Why it matters more than every before

- Unlocking ESG: Why it matters and how to enhance compliance

- Aligning with global standards: A practical ESG guide for every organisation

- ESG Roadmap: Courses you need to comply

- Your essential ESG whitepaper: Key insights for Australian businesses

- Compliance Corner Podcast | Future proof or fall out: The ESG question

Summary of changes

Environmental, Social and Governance mandatory climate-related financial disclosures

- As of 1 January 2025, large Australian companies and financial institutions (Group 1 entities) are required to incorporate climate-related financial disclosures into their annual reports. This mandate follows the enactment of the Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024, which received Royal Assent on 17 September 2024.

- Group 2 and Group 3 entities, as defined under the Corporations Act, will be required to comply in subsequent reporting years as part of a phased implementation approach.

- The disclosures must align with the Australian Sustainability Reporting Standards (ASRS), specifically:

- AASB S1: Sustainability-related Financial Information

- AASB S2: Climate-related Disclosures

- These standards are based on the international IFRS S1 and S2 issued by the International Sustainability Standards Board (ISSB), supporting alignment with global disclosure requirements.

- The standards require entities to report on:

- Climate-related risks and opportunities

- Their governance, strategy, and risk management processes

- Metrics and targets, including greenhouse gas emissions.

- The implementation of these standards will boost transparency, accountability, and investor confidence by ensuring consistent, comparable data on how companies address climate-related issues. This move aligns Australia with other jurisdictions, including the EU, UK, New Zealand, and Japan, in establishing a rigorous and internationally aligned climate disclosure regime.

- The Australian Securities and Investments Commission (ASIC) will be responsible for compliance and enforcement.

- Company directors may be held accountable for misstatements or omissions in sustainability disclosures, in line with existing obligations under the Corporations Act.

- To support compliance, entities are encouraged to proactively engage with these requirements and prepare for the upcoming reporting obligations.

Final thoughts: Lead the change in climate reporting

The shift to mandatory climate disclosures is driving the integration of climate risk into core business strategy.

Now is the time to review reporting practices, empower leadership, and actively take steps to meet new disclosure requirements. Compliance is only the first step—lasting impact comes from embedding sustainability into your company’s culture and decision-making.

If you need help navigating these new obligations, we’re here to provide tailored advice, resources, and tools to assist you.

Ready to lead with confidence?

We’re here to help you meet new climate reporting standards with clarity and confidence.

Get the latest news

Stay updated with the latest news and expert insights on compliance, legislation, and industry trends.

Share

Latest news & insights

- 3 min

- 5 min